Irs w4 estimator

Use the withholding estimator at IRSgov to estimate your federal withholding. IRS tax forms.

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

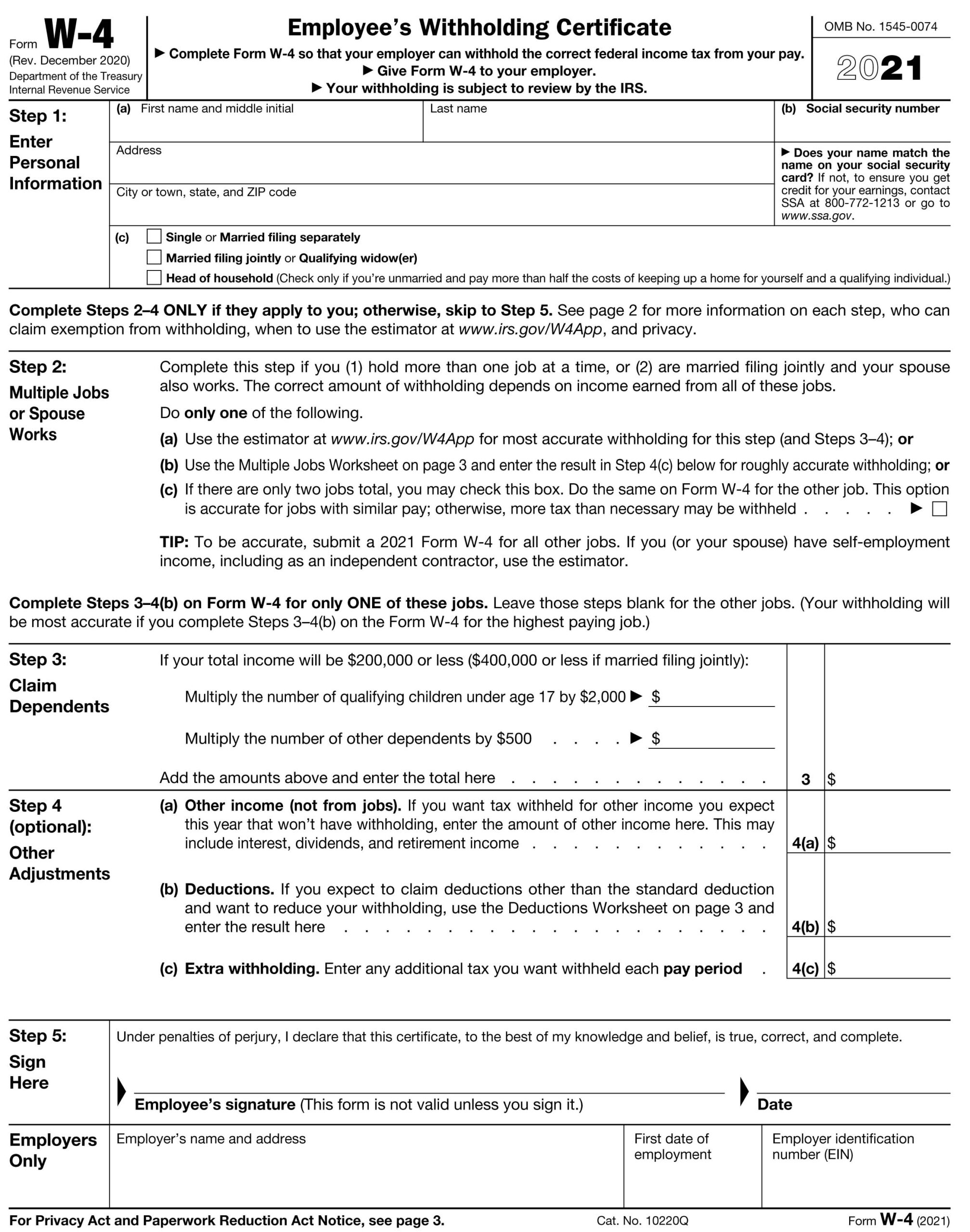

If you have concerns with Step 2c you may choose Step 2b.

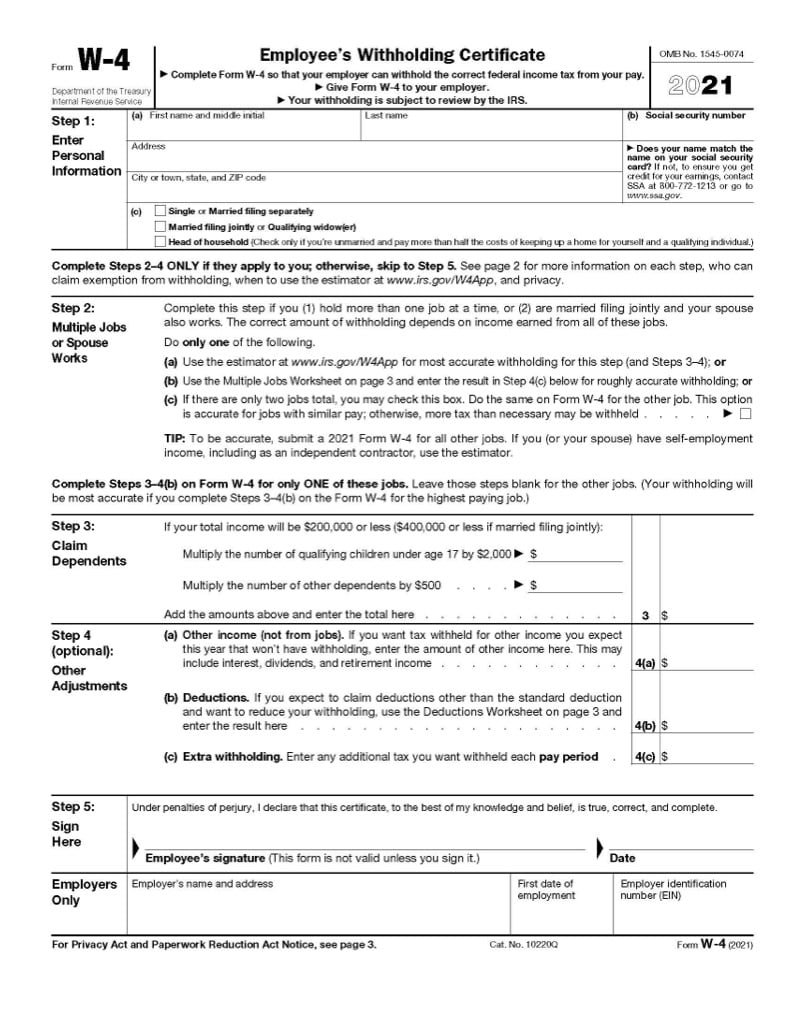

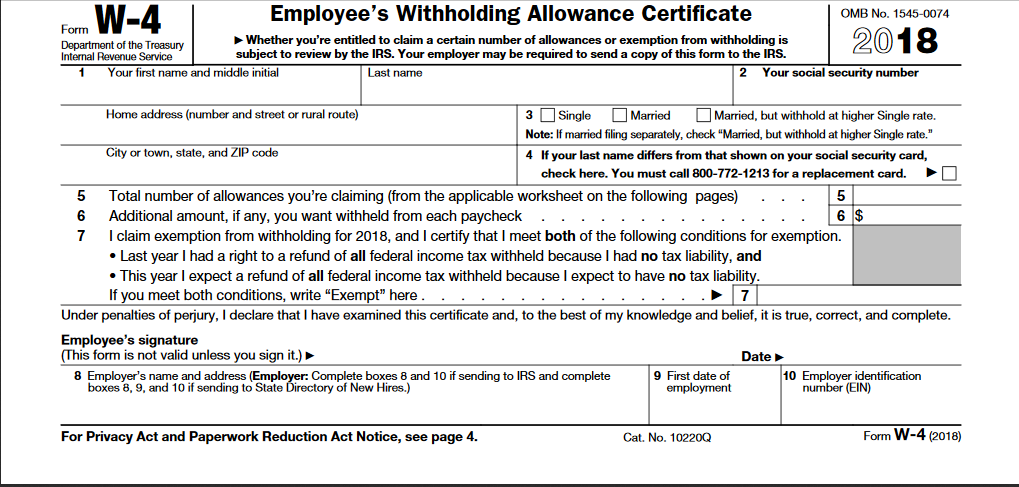

. Start with the Back Tax Calculators and tools to estimate your back taxes. IRS Standard Tax Deductions 2021 2022. The IRS redesigned Form W-4 in 2020 and did away with the ability to claim personal allowances.

Select one or more states and download the associated back tax year Forms. The IRSs W-4 estimator or NerdWallets tax calculator can also help. If you have concerns with Step 4a you may enter an additional amount you want withheld per pay period in Step 4c.

What to keep in mind when filling out Form W-4. Your withholding will be most accurate if you complete Steps 34b on the Form W-4 for the highest paying job Step If your income will be 200000 or less 400000 or less if married filing3. Previously a W-4 came with a Personal Allowances Worksheet to help you calculate what allowances to.

Complete sign and mail in the forms to the address on the form. As a result of the latest tax reform the standard deductions have increased significantly however many other deductions got discontinued as a result of the same tax reform. Id still suggest either using the Tax Withholding Estimator or consulting your accountant to ensure you have the correct calculations.

Use page 2 of the Form ID W-4 to estimate your Idaho withholding. See previous IRS or Federal Back Tax Forms. It can also help you avoid overpaying on your taxes so you can put more money in your pocket during the year.

Accurately completing your W-4 can help you prevent having a big balance due at tax time. The W-4 form has changed. Maximize your refund with TaxActs Refund Booster.

Leave those steps blank for the other jobs. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck. Do you owe 2017 Taxes to the IRS.

For details on how to protect yourself from scams see Tax ScamsConsumer Alerts. If you fill out Step 3 multiply the number of children under age 17 by 2000 and put the amount on the line. Marital status relationship to the.

Contractor use the estimator. Use our handy Guide to the New W4 for a visual. These standard deductions will be applied by tax year for your IRS and state returns respectively.

Steps 2 through 4 use the online estimator which will also increase accuracy. The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers. Fill out Form ID W-4 with that information.

Update the federal Form W-4 with that information. We dont save or record the information you enter in the estimator. For all other dependents multiply.

Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form. If there are more than two jobs use the Multiple Jobs Worksheet on page 3 or the estimator to ensure you are withholding enough. If this is the.

Back Tax Forms and Calculators. IRS 1099 Form Explained Everything You Need To Know. Once you have your numbers then you can plug them into the form.

The W-4 Form is an IRS form that you complete to let your employer know how much money to withhold from your paycheck for federal taxes. To ensure that you get the best refund or even just a tax break first get your accurate numbers by using the online IRS Withholding Estimator a couple of times a year and adjust your W-4 as your earnings fluctuate. Yes you can enter 9000 on the dependent line in QuickBooks PDController.

Complete Steps 34b on Form W-4 for only ONE of these jobs. Also as per IRS guidelines there are information youll need when determining whom you claim as a dependent. If all this reading is not for you.

As an alternative to the estimator.

2

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

What Do You Do With A W4 Tax Form Jackson Hewitt

Irs Improves Online Tax Withholding Calculator

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Irs Releases New 2018 W 4 Form

Understanding Your W 4 Mission Money

W 4 Form Basics Changes How To Fill One Out

The New Irs Form W 4 Has Many Scratching Their Heads Here S What You Should Know Komo

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

How To Fill Out Irs Form W 4 2020 Married Filing Jointly

Tax Forms Easy Tax Store

Form W 4 Employee S Withholding Certificate 2021 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Internal Revenue Service

What Is Irs Form W 4

Irs Witholding Calculator